Are Robo-Advisors Redefining Wealth Management or Just Digitizing It?

FAQ 263

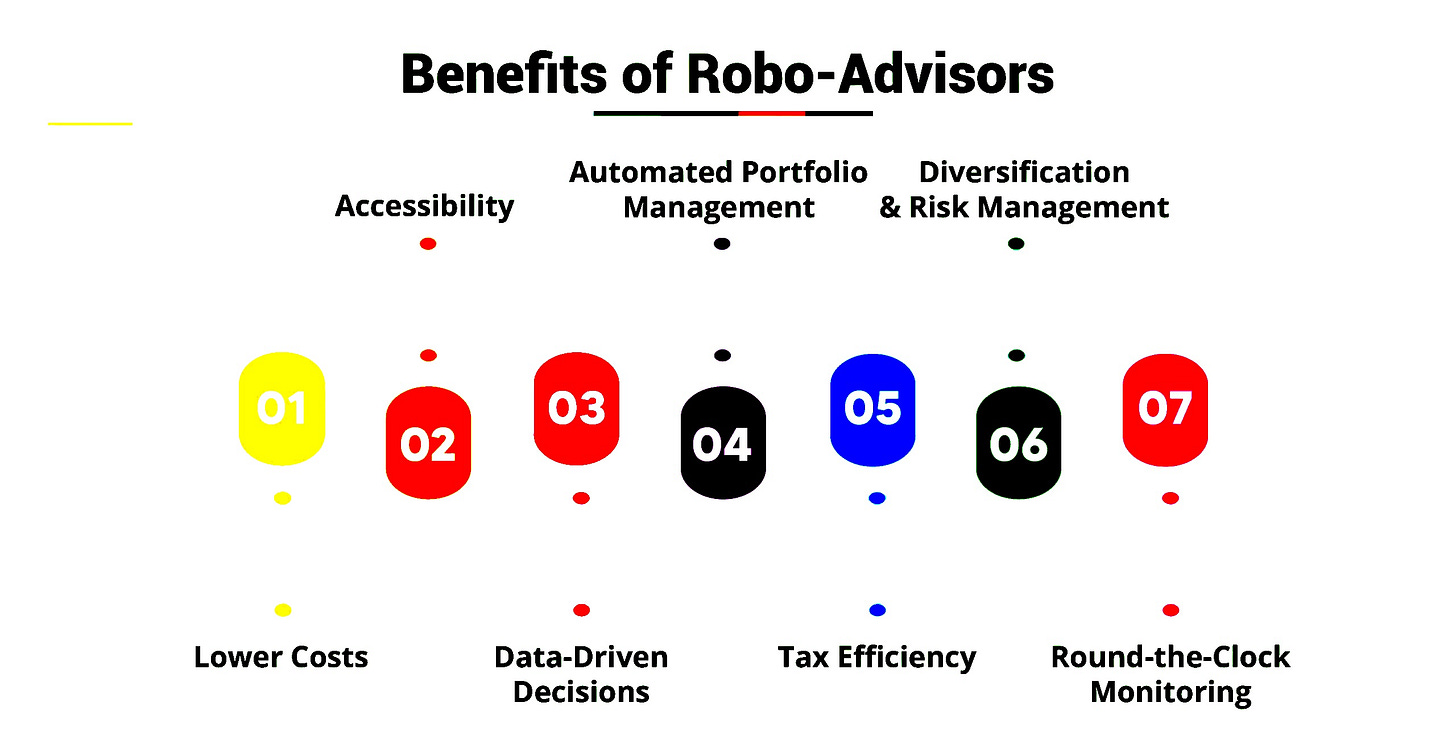

Are robo-advisors truly transforming wealth management or simply giving it a digital facelift? These automated platforms offer low-cost, data-driven investing and personalized portfolios once reserved for the elite. Schedule your one-on-one consultation today. Click now to schedule your introductory call.

How do you like the content? Please let us know in the comments below.

Technology has revolutionized the way we invest. From trading apps to digital banks, innovation has made finance more accessible, transparent, and data-driven. But one of the most debated shifts in personal investing is the rise of robo-advisors, automated platforms that build and manage portfolios using algorithms instead of human advisors.

At first, robo-advisors seemed like a fintech experiment, a low-cost alternative for tech-savvy investors. Today, they collectively manage over a trillion dollars globally, reflecting the defining role digital automation plays in modern investing.

As investors and institutions focus more on efficiency, transparency, and data-driven choices, robo-advisors are transforming not just portfolio management but the entire approach to building wealth. Ready to explore how this digital revolution is changing the future of investing? Let’s dive in!

The Rise of Algorithmic Advice

Robo-advisors emerged after the 2008 financial crisis, when investors demanded low-cost, transparent solutions that avoided human bias. The model is simple: users answer questions about their goals, risk tolerance, and time horizon, and the platform constructs a diversified ETF portfolio aligned with Modern Portfolio Theory (MPT).

Once the portfolio is created, the system automatically rebalances it, optimizes taxes, and monitors performance, all without human input. For many, this offers a disciplined, emotion-free investing experience that even experienced investors struggle to maintain during market swings.

Why Investors Are Turning to Automation?

Robo-advisors appeal to investors for three clear reasons: cost, convenience, and consistency.

Lower Costs: Traditional wealth managers often charge around 1% of assets under management. Robo-advisors typically charge between 0.25% and 0.40%, with some platforms offering lower entry tiers. The difference compounds significantly over time, especially for long-term investors.